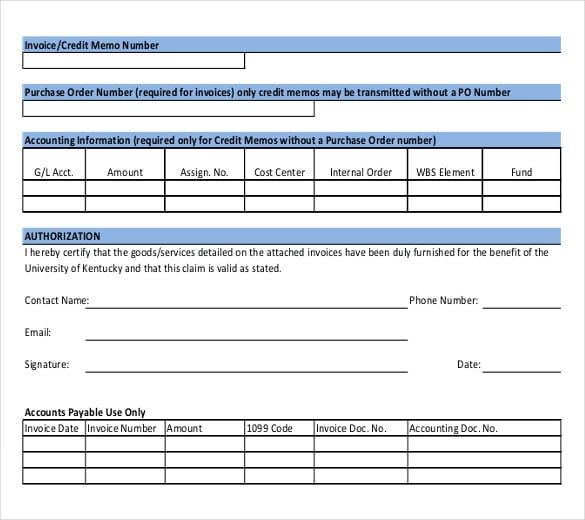

CREDIT MEMO TEMPLATE SOFTWARE

The invoicing software you use should provide you with a template to generate a credit note from an invoice you had already created. As an invoice is a legally binding document, there are certain details that it needs to include. What Should Be on a Credit Invoice?Ī credit invoice will usually follow the same structure as a normal invoice. This helps to keep your client’s account up to date and you can adjust your accounts receivables and sales tax records accordingly. Keeping a credit invoice on file will instead show that the money came in from the customer and was then returned in the form of credit. Removing an invoice from the system might not even be possible and isn’t generally considered good practice. It helps to keep accounting records clear and accurate. One benefit is that it is often more accurate than simply removing the invoice from the system. What Are the Benefits Of Using a Credit Invoice? It can also leave your books short by not properly accounting for money coming in and going out. It can therefore be difficult to work out what happened in a matter where a clear paper trail isn’t kept. It is almost impossible to keep track of every sale for each customer. It is a way of recording the original sale on the system in the event of a refund and return. Keep a record of the initial sale in your accountsĪ credit invoice helps you to keep your accounts in good order.If you’ve invoiced a customer by mistake, you can give them a credit invoice to show that they don’t need to pay. If an outstanding balance is still required, a further credit memo can then be produced taking into account what has already been paid.Īgain, mistakes are inevitable when running a business.

CREDIT MEMO TEMPLATE FULL

Regular customers may already have paid some money on account and want to use this as full or partial payment of their bill.Ī credit invoice can therefore be used by business owners as a form of receipt for the customer. The amount on the original invoice might have been wrong due to not applying a discount or adding figures incorrectly.Ī credit note can be used to rectify the problem for the customer.

There is a wide range of circumstances that might lead to you preparing a credit invoice for a client. Let’s Wrap It up When and Why Should You Use a Credit Invoice? What Are the Benefits Of Using a Credit Invoice?Īccounting for Credit Invoices in Your Bookkeeping

When and Why Should You Use a Credit Invoice? Here’s how you should handle processing a credit invoice. Where this happens, a credit note can be used to “credit” the customer the amount due to them. Occasionally, there will be a need for either all or some of the money paid to be returned to a client. When you send a customer an invoice, you’re requesting payment from them for goods or services you have provided.Ī customer will then usually pay your invoice and complete the transaction. It’s a tool that can be particularly useful to small businesses. Well, it’s the same thing and the terms are often interchangeable. You may have heard the terms credit note and credit memo before. Credit invoices are a useful way for businesses to account for mistakes and customer refunds in the accounts.

0 kommentar(er)

0 kommentar(er)